10 October 2025

Maptitude is the ideal mapping software for use within the banking industry. GIS is a critical tool in today's banking environment, where there is increased competition both from existing and new banks, as well as from new companies such as Internet and phone banks, and from retail-based incursions into traditional financial markets.

Maptitude provides those in the banking and financial industry with the geographical tools to obtain the answers to compete effectively, and to ensure compliance and customer service levels.

Maptitude provides powerful spatial tools for:

| Highlights |

|---|

|

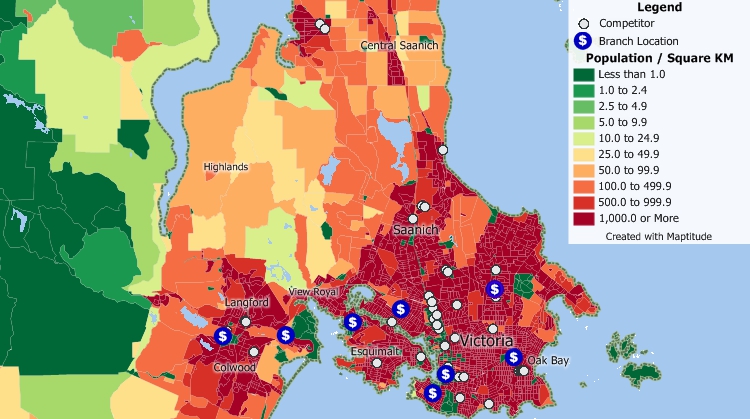

Using Maptitude you can visually simplify the weighing of the pros and cons of different sites for branches and ATMs/ABMs/cash machines. You can pinpoint where your customers, facilities, and competitors are with powerful address locating and database management and query tools. You can then examine the demographic characteristics of your customers with the included Census data. Provided with this knowledge you can identify underserved areas, analyze your competitor's market, and create an acceptable branch and cash machine network.

Examine your branch locations, the locations of competitors, and demographic characteristics

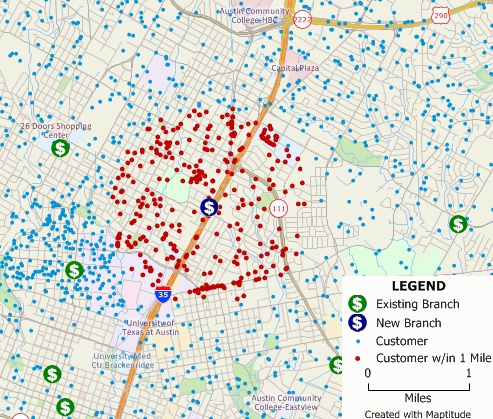

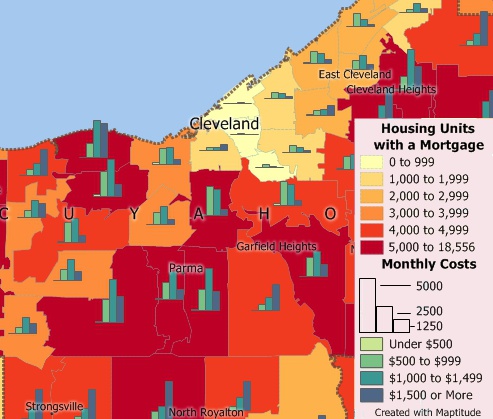

Use your own data or the Census demographic data to identify the market areas, communities, or Postal/ZIP Codes that have particular characteristics so you can target your marketing efforts. For example, you can identify Postal/ZIP Codes with high mortgage costs to target an advertising campaign about your refinancing mortgage programs, or find the customers who are within several miles of a new branch or ATM/ABM/cash machine location for a specialized mailing to inform them about their new banking options.

Customers within 1 mile of a new bank branch who would be candidates for a direct mail campaign to inform them of their new option.

The number of mortgaged housing units and monthly mortgage costs for all mortgaged housing unit by ZIP Code

|

“We've been using Maptitude for more than 20 years. It is by far 'the best bang for the buck' in GIS software. I can't believe the amount of demographic data that comes with the product. The sophistication is incredible, but the software is relatively simple to use. We've been using Maptitude to map our CRA Assessment Areas for banks. We also use it for branch impact studies (required by regulators). When we started using drive-time rings to determine the practical service area of bank branches the regulators were really impressed.”

|

|

“When we are helping financial institutions create and define geographically targeted market segments, HMDA and CRA Small Business analysis, loan trends, Competitive Analysis, market share, Business and Deposit trends - our tool of choice is Maptitude. It is one of the most affordable and feature-packed desktop GIS software in the market. It comes bundled with all the Census and other spatial data related to the financial service industry.”

|

GIS is critical in enabling banks to comply with government requirements such as the Home Mortgage Disclosure Act (HMDA). You can use your own lending data with Maptitude to create Community Reinvestment Act (CRA) maps that verify HMDA compliance and non-discriminatory lending practices.

Maptitude includes the Federal Financial Institutions Examination Council (FFIEC) Census Tract demographics to support the consumer compliance examination process. The FFIEC Census data are required for compliance under HMDA, CRA, and fair lending.

In addition to the extensive Census data supplied with Maptitude (including the latest Census Tracts), there are several additional datasets available from Caliper. These include:

In addition, Caliper offers HMDA datasets that contain records for all the loan applications processed by every financial institution required to file by HMDA. These data are available for every year from 1990 thus allowing time series analysis, and are also available as a geographic layer aggregated by Census Tract.

More examples of the application of GIS in banking & retail banking can be found on the Maptitude Articles page.

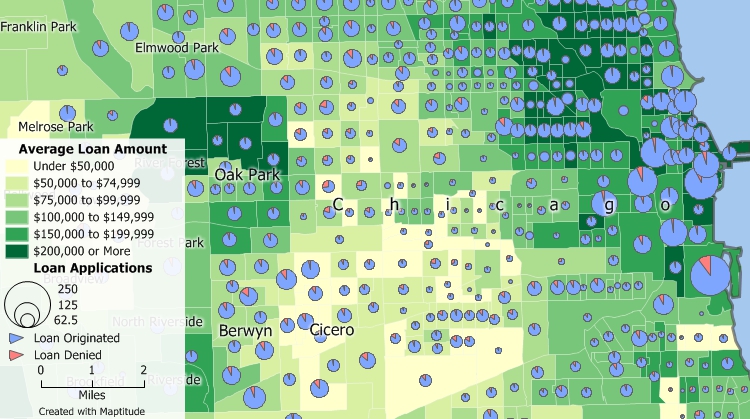

Home Mortgage Disclosure Act (HMDA) loan data for the Chicago area shows census tracts shaded by the average loan application amount. The pie charts on each tract are scaled by the number of loan applications, and show the portions of loans that were originated and denied.

How Digital Finance Analytics Assesses Financial Stress with Maptitude

How Digital Finance Analytics Assesses Financial Stress with Maptitude

Geographic Information Systems (GIS) play a crucial role in banking by enabling spatial analysis of financial data. Banks utilize GIS to map and analyze geographical patterns related to their operations. This includes assessing the distribution of branches, identifying target markets, and evaluating the potential risks associated with specific locations. GIS helps in optimizing site selection for new branches, managing assets across diverse geographic areas, and improving decision-making processes.

GIS in banking stands for Geographic Information Systems. It is a technology that integrates geographical data with other relevant information to analyze and visualize spatial relationships. In the banking sector, GIS is employed to gain insights into geographical patterns and make informed decisions related to branch locations, market analysis, and risk assessment.

The benefits of GIS in finance are multifaceted. Some key advantages include:

In accounting, GIS is utilized for spatial analysis of financial data and resource management. Some common applications include:

Check out our G2 Reviews

Check out our G2 Reviews

Home | Products | Contact | Secure Store